Investing with precision: Oncology

By Alexandra | April 13, 2023

Written by Pavel Artemov & Henry Taysom, Creator Fund

Precision Medicine is a nebulous and often over-promised idea. After decades of research and investment, it has one true standard-bearer, oncology. The personalised treatment of cancer has reached a tipping point. More money goes into treating cancer than any other disease, and few diseases have more complexity. It might be The Emperor of All Maladies, but the singular force of the word cancer hides its true diverse nature. In this article we look at how startups and investors should be approaching the field.

The Potential of Precision Oncology

We typically describe someone as having “cancer” and add the organ to give more detail. The reality, however, is that “breast cancer” or “liver cancer” is itself broken down into dozens of subtypes. There are infinitely separable classifications, and with granularity, we increase treatment options.

For example, we now talk of breast cancer in terms of its receptor status. Cells that exhibit a protein called HER2 are treated with Herceptin, but ER-positive breast cancers are treated with hormone therapy, such as Tamoxifen. Some patients display no cellular markers — triple-negative breast cancer — as a result, they cannot be treated with certain drugs and must endure chemotherapy, which has its scientific origins in chemical weaponry, with side effects that sustain this heritage.

With each new drug on the market, we find a specific population of patients for whom the drugs do not work. As modern medicine increases the speed of drug development, the rate at which we discover new cancer subtypes grows. We also understand more about how a patient’s biology, i.e genetics, metabolism and environment, impact their response to a given treatment. This is the core of Precision Oncology.

Cancer is not one disease; it is hundreds of categories and subcategories. A person is not an anonymous patient; their genetics and epigenetics can determine how they should be treated.

There is a race between our understanding of cancer and our ability to treat it. We need cutting-edge methods for asset identification, prioritisation, testing, and implementation that can keep up.

This is why Oncology is at the vanguard of precision medicine. The long search for a cure for cancer is more accurately the search to provide each cancer patient with the proper treatment. As pre-seed investors, we see early-stage biotech companies making an important contribution to this search. This is where we see the opportunity for early-stage companies to have the biggest impact on the field:

Companion Diagnostic Tools (CDX)

CDX tools quickly identify biomarkers that can guide the therapy of patients and ease their stratification. The expansion in data-set quality and quantity has accelerated the Machine Learning (ML) and Artificial Intelligence (AI) push for improvement, leading to, limited in fundamental understanding but impressive in general, models such as new image-based classification methods for lung cancer lesions.

The trend towards open-source software solutions has created a lower barrier of entry for new players that employ AI techniques on genetic and omics data. This means that CDX should think about their differentiated value add. An example of this is Turing Biosystems (Pictured to the right), an investment we made in November. Turing Bio are a team of French PhDs using AI to identify oncology targets. They are focused on the issue of “explainability”. Pharmaceutical companies or clinicians want to understand how an AI model has reached a given conclusion. The stakes are life and death. However, machine learning is often a black box that is hard to interrogate. Turing Biosystems uses Automated Reasoning (and not Machine Learning) to ensure it is fully explainable and interoperable for the end user.

Software-Enabled Hardware

Turing Biosystems realised that the computing power of existing solutions was too slow to run Automated Reasoning over billions of clinical data points in a time-efficient way. So they optimised the software with hardware — using reprogrammable chips based on field-programmable-gate-arrays (FPGAs) to match biomarkers/targets and outcomes across the stacked multi-omics dimensions.

Historically — hardware investment has been difficult due to its capital expenditure risks. However, as is becoming evident across other industries, with the advent of biological and quantum computing, we are running at pace towards an inevitable inflection point where software cannot overcome this oversight. We welcome improvements in companion diagnostic tools that add an additional layer of innovation beyond the latest open-source ML tool, including those that are hardware or ‘wet-lab’ based approaches.

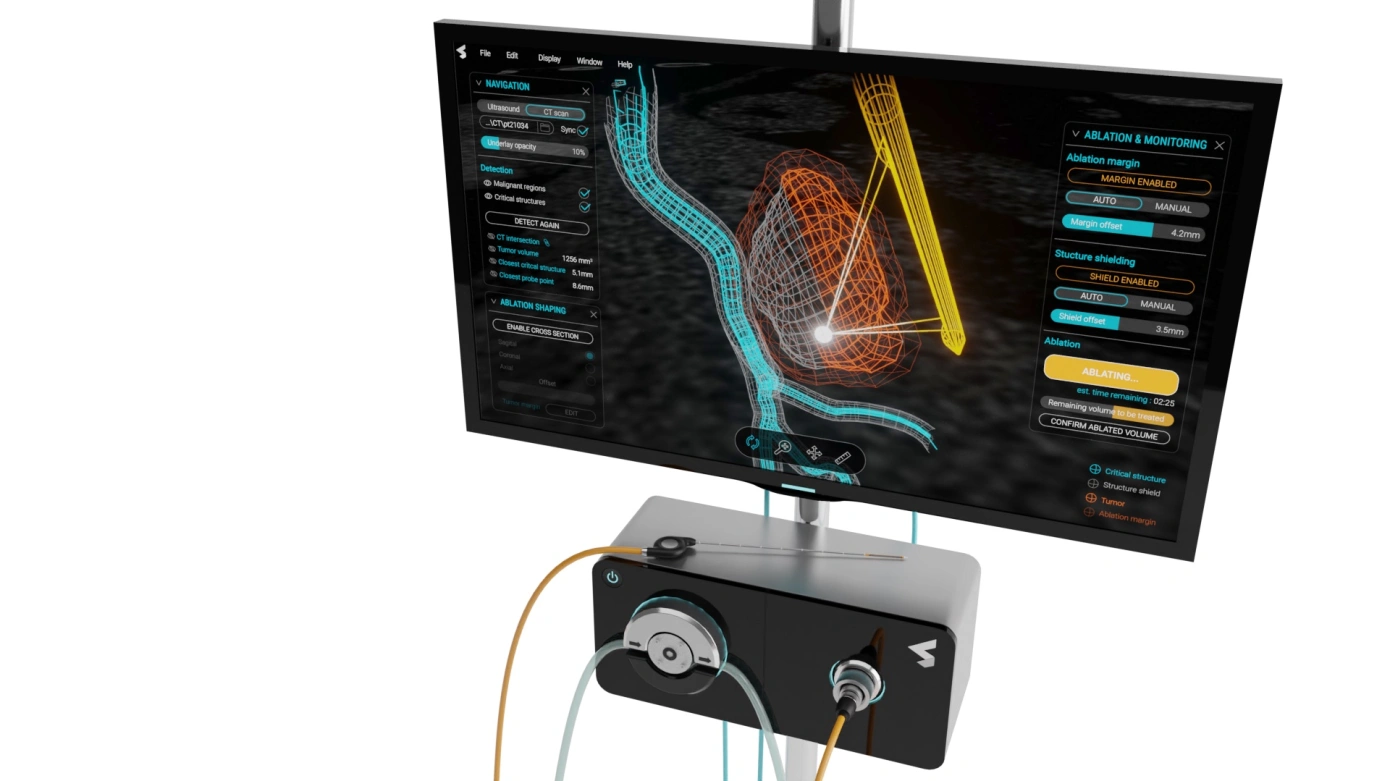

A good example of this is Current Surgical, which recently raised $3.2mm to develop a smart needle that treats cancerous tumours, avoiding more invasive surgery that can hurt surrounding organs. Their accompanying software stack allows clinicians to see and analyse the tumour in real time.

Platform Technology

Oncology is a broad field, and with increased specificity, real value will come from developing a unique method that can be used repeatedly. This is a platform. An approach that can be used to diagnose different patients, create multiple drugs, deliver drugs across multiple sites, or continue to identify novel assets.

Inevitably the journey of becoming a platform starts small and works out, solving a niche and expanding, but the latter agility must be built in or accounted for in the earliest possible stage of development. We see some companies focus only on a single causal protein or gene paired against a class of drugs. This is extremely resource intensive and leads to a single point of failure in the drug discovery R&D process.

GRAIL built a platform that can be used to diagnose dozens of cancer subtypes using one small blood biomarker of the tumour and has conducted half a dozen of clinical trials. In addition, the recent acquisition of Foundation Medicine (acquired by Roche for $2.4 billion) is an example of a platform business, connecting molecular insights, physicians, patients and biopharma partners.

We invested in a sequencing platform Caeruleus Genomics from Oxford University in December. It has developed next-generation genetic sequencing, which combines long-read and single-cell sequencing, vastly reducing complexity and expanding ‘omics data and phenotypical knowledge about cancer and its underpinnings.

Delivering substantial benefits within the healthcare system

There is no point in innovation without intervention improvement; the solution identified has to add benefit to the patient. NICE sets UK healthcare guidelines for treatments based on the quality-adjusted life years gained as a result of the intervention and costs associated with it. While this metric may be premature at pre-seed, it helps unearth what the founder’s expectations or goals are, as well as highlighting an understanding of their go-to-market strategy whilst maintaining a good return on investment from a healthcare point of view. In other words: we’re here to invest in future benefits, not the prolongation of a research project.

The best means to achieving this is the cross-pollination of ideas across domains, and again our portfolio company Turing Biosystems highlights this — bridging semiconductors development and immuno-oncology.

Simplifying existing healthcare infrastructure

Healthcare processes need to be simplified. But simultaneously, you cannot swim against the tide of how the NHS works. Adaptability and knowledge of how complex healthcare systems operate allow technology to be adopted faster.

One clear example of this, from the patient’s perspective, is the shift that the insulin pump has brought to diabetes care, a move towards autonomy, but with sufficient oversight from clinicians to ensure safety. As the market grows and the number of spin-outs from research alongside it — we must be wary of GTM strategies relying on the adoption of novel biomarkers or whole-genome sequencing. Instead, interrogable, simplified, ‘in-time’ technologies must be focused on. We see a gap in the market here, though not without existing big players being included in these developments, where enough information to guide treatment is harnessed whilst storing the rest for the betterment of future knowledge.

Conclusion

Precision oncology means ensuring each cancer patient is paired with the right treatment pathway, and each new drug is targeted to the right patient group. Technology has now taken us to a place where the term is no longer a buzzword. There is now a real opportunity to develop the tools to diagnose earlier, stratify patients more accurately, deliver more personal care, and as a result, more effective therapy.

No development in Precision Oncology is truly useful until it is paired with patient, pathway and is holistic in its depth. As a VC, we look for companies that achieve outsized scale. These are not necessarily Nature Cover articles. They are a whole stack approach from the tech to the bedside to the patient’s home, driving innovation, without excess complication, from visionary founders who are not afraid to look outwards from their speciality.

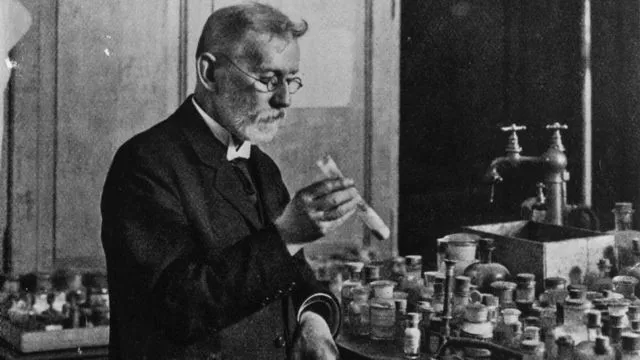

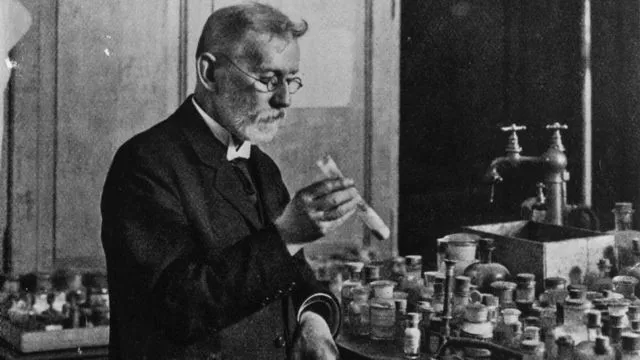

Over 100 years ago, Paul Ehrlich (pictured right) envisioned therapies as ‘magic bullets’– specific chemicals that kill specific tumour cells. Although today we are looking for platform approaches, as opposed to single asset R&D, we continue to agree that his recipe for success: Geduld (patience), Geschick (skill), Geld (resources) and Gluck (luck) will translate into Gesundheit (health).

Pavel Artemov and Henry Taysom are Life Sciences investors at Creator Fund. Pavel is undertaking a PhD at Imperial College, where he researches mechanisms underpinning drug resistance in lymphoma. He combines computational and laboratory approaches in his work. Henry is an A&E Registrar, undertaking an engineering translational masters at Imperial.